Protect Your Family While You Work in Australia

Be covered with $200,000 in life insurance through your employer's group insurance program. It's simple, affordable, and designed for international contract workers.

What is life insurance?

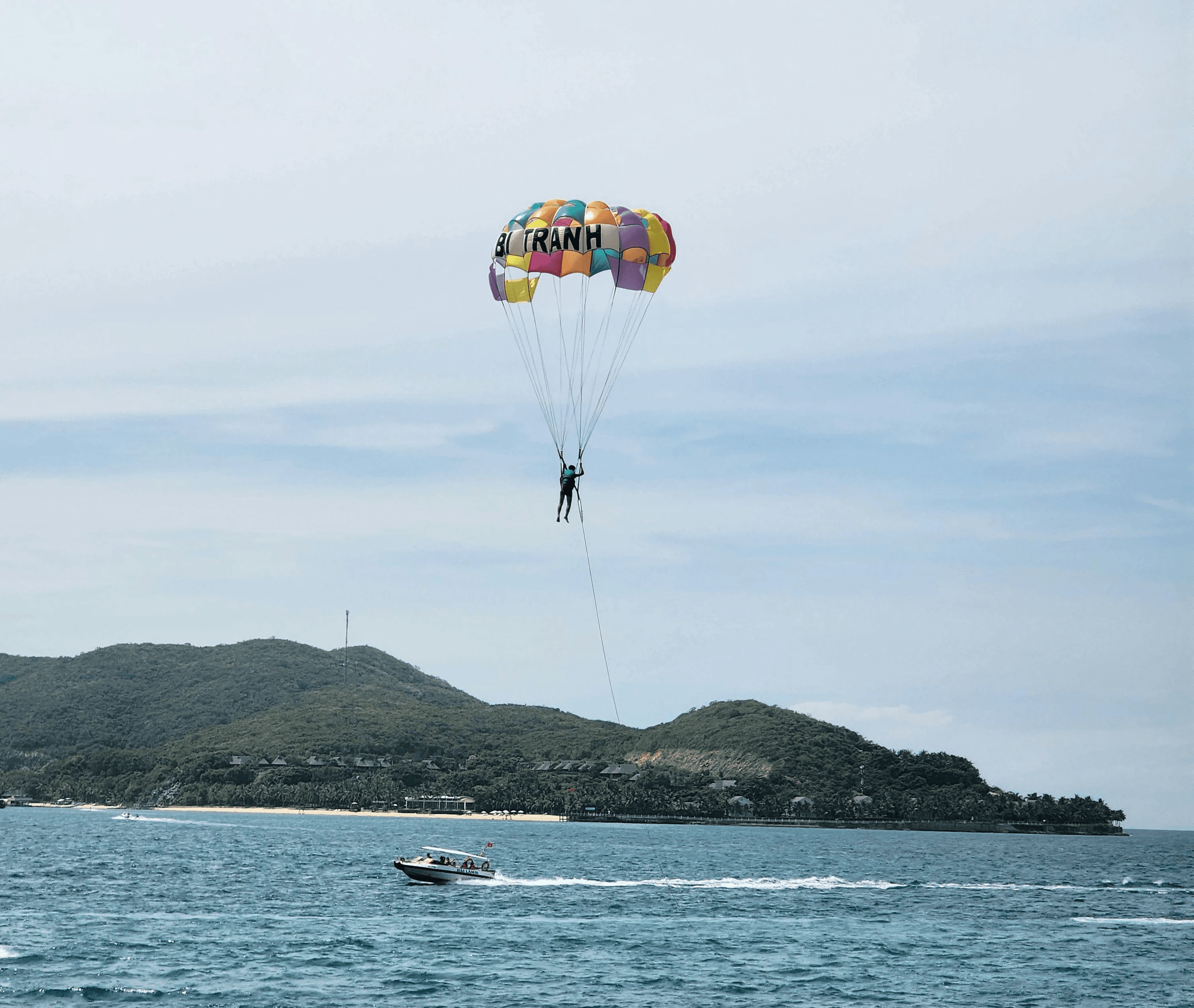

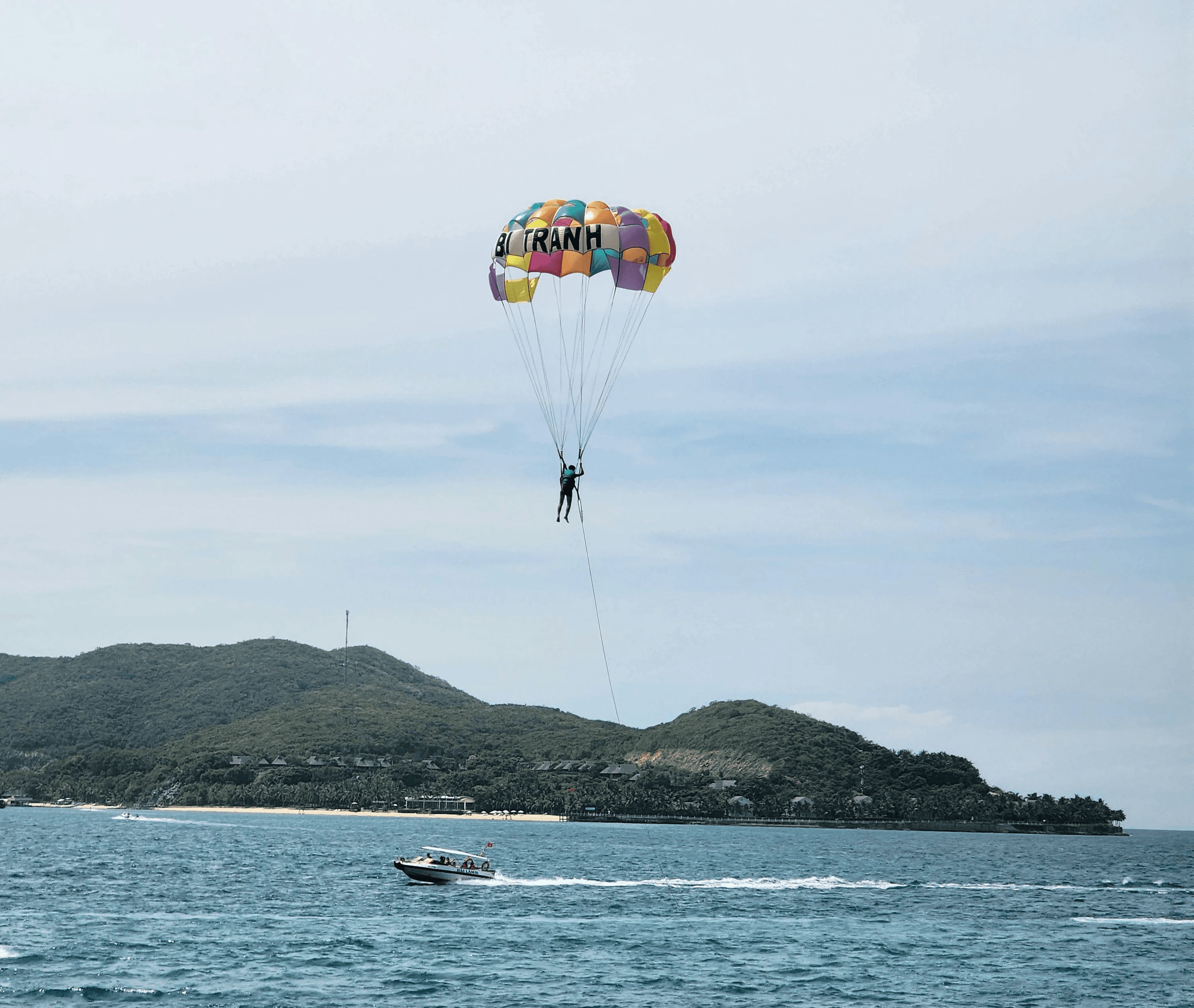

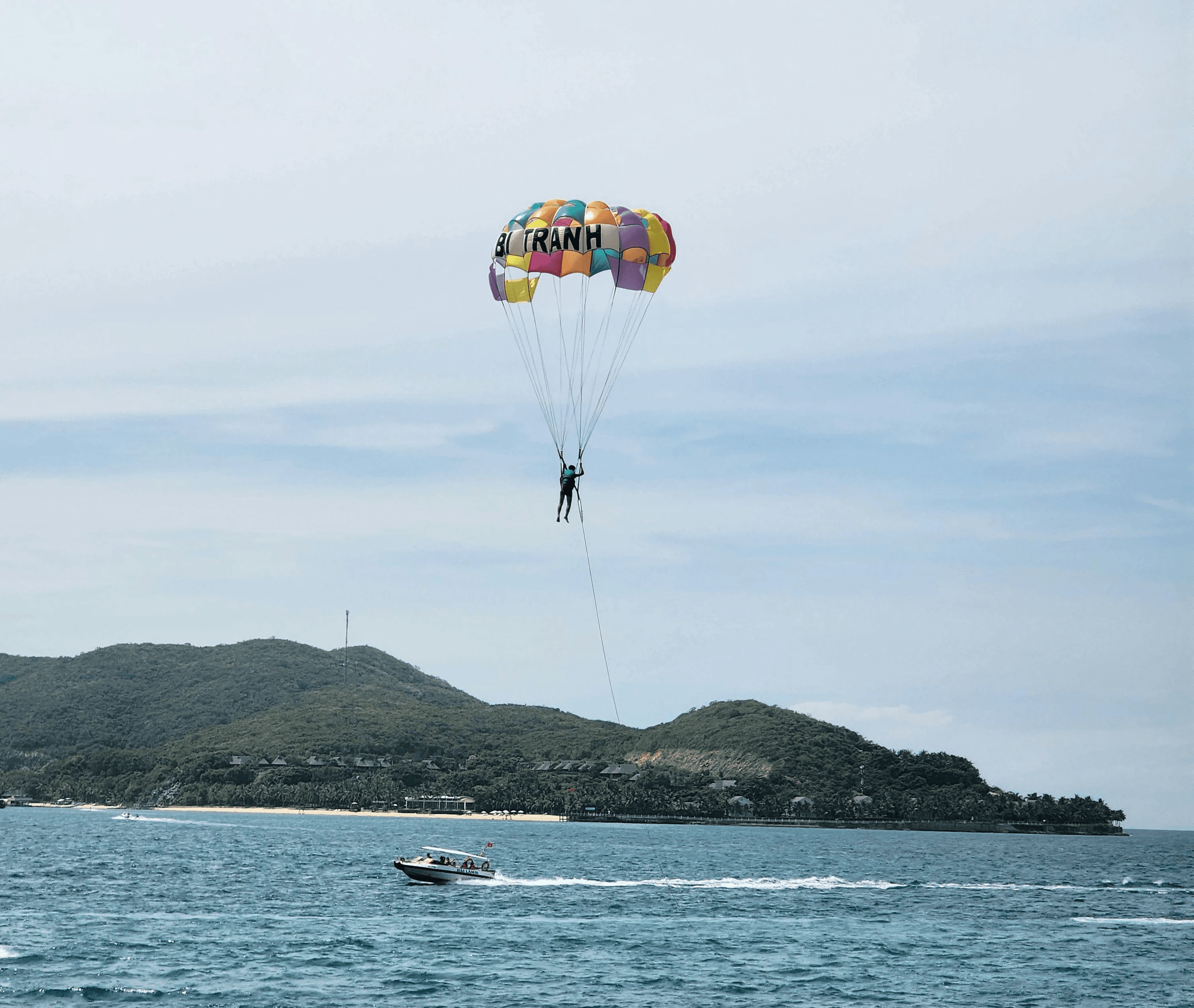

A Parachute for Your Family

Life insurance is like a parachute for your family - if something happens to you, it helps them land safely with a $200,000 payment. This applies whether you pass away or are diagnosed with less than 12-24 months to live.

Group life insurance means it's organised by your employer, allowing them to "buy in bulk" for all workers and get better prices and a simpler process - no health checks or long application forms.

Life insurance is like a parachute for your family - if something happens to you, it helps them land safely with a $200,000 payment. This applies whether you pass away or are diagnosed with less than 12-24 months to live.

Group life insurance means it's organised by your employer, allowing them to "buy in bulk" for all workers and get better prices and a simpler process - no health checks or long application forms.

What is life insurance?

A Parachute for Your Family

Life insurance is like a parachute for your family - if something happens to you, it helps them land safely with a $200,000 payment. This applies whether you pass away or are diagnosed with less than 12-24 months to live.

Group life insurance means it's organised by your employer, allowing them to "buy in bulk" for all workers and get better prices and a simpler process - no health checks or long application forms.

The details

$200,000 of Protection for the Cost of a Weekly Snack

One Large $200,000 Payout

Your family will receive the full $200,000 in one upfront payment, all for the cost of a weekly snack.

One Large $200,000 Payout

Your family will receive the full $200,000 in one upfront payment, all for the cost of a weekly snack.

Be Covered Everywhere

You're covered 24/7 wherever you are - while working, sleeping, relaxing, or visiting home overseas.

Be Covered Everywhere

You're covered 24/7 wherever you are - while working, sleeping, relaxing, or visiting home overseas.

Total Spending Flexibility

The money can be used on anything your family chooses - funeral costs, living expenses, debts, or school fees.

Total Spending Flexibility

The money can be used on anything your family chooses - funeral costs, living expenses, debts, or school fees.

The details

$200,000 of Protection for the Cost of a Weekly Snack

One Large $200,000 Payout

Your family will receive the full $200,000 in one upfront payment, all for the cost of a weekly snack.

Be Covered Everywhere

You're covered 24/7 wherever you are - while working, sleeping, relaxing, or visiting home overseas.

Total Spending Flexibility

The money can be used on anything your family chooses - funeral costs, living expenses, debts, or school fees.

Organised by Your Employer for Your Wellbeing

As part of their commitment to their workers, your employer organises group life insurance for everyone, making it simpler and more affordable than individual life insurance.

No health assessments required

No health assessments required

Affordable group discount rates

Affordable group discount rates

Easy opt-in and opt-out

Easy opt-in and opt-out

No Australian residency required

No Australian residency required

Organised by Your Employer for Your Wellbeing

As part of their commitment to their workers, your employer organises group life insurance for everyone, making it simpler and more affordable than individual life insurance.

No health assessments required

Affordable group discount rates

Easy opt-in and opt-out

No Australian residency required

You Choose Who Receives the $200,000

When you sign up, you pick who gets the money - this could be your spouse, children, parents, or anyone else important to you. You can even split it between multiple people, and you're free to change your choices at any time.

Spouse or partner

Spouse or partner

Children or parents

Children or parents

Multiple family members

Multiple family members

Anyone else you care about

Anyone else you care about

You Choose Who Receives the $200,000

When you sign up, you pick who gets the money - this could be your spouse, children, parents, or anyone else important to you. You can even split it between multiple people, and you're free to change your choices at any time.

Spouse or partner

Children or parents

Multiple family members

Anyone else you care about

Claims Handled in 3 Steps

1

Notify

Your family contacts your employer's admin team to report what happened.

1

Notify

Your family contacts your employer's admin team to report what happened.

2

Claim

Your employer informs the insurer, and they start the claims process.

2

Claim

Your employer informs the insurer, and they start the claims process.

3

Payout

If approved, the insurer pays the $200,000 to the people you selected.

3

Payout

If approved, the insurer pays the $200,000 to the people you selected.

Claims Handled in 3 Steps

1

Notify

Your family contacts your employer's admin team to report what happened.

2

Claim

Your employer informs the insurer, and they start the claims process.

3

Payout

If approved, the insurer pays the $200,000 to the people you selected.

Does life insurance really get paid out?

In Australia, it’s very likely. A regulatory body checks in on it. Here’s their latest payout data for group life insurance.

98.7%

98.7%

of Life Insurance claims were paid out in 2024.

Does life insurance really get paid out?

In Australia, it’s very likely. A regulatory body checks in on it. Here’s their latest payout data for group life insurance.

98.7%

of Life Insurance claims were paid out in 2024.

Getting Started Only Takes One Step

Contact your employer and let them know you're interested in joining the group life insurance program. They'll handle all the paperwork and sign-up process for you.

Getting Started Only Takes One Step

Contact your employer and let them know you're interested in joining the group life insurance program. They'll handle all the paperwork and sign-up process for you.

Getting Started Only Takes One Step

Contact your employer and let them know you're interested in joining the group life insurance program. They'll handle all the paperwork and sign-up process for you.

Some Frequent Questions

What happens when I finish my current job contract?

If you leave the company, you have the option to continue your cover by converting it to a personal plan. This lets you keep all your benefits without needing medical exams or health screenings.

Can I cancel my life cover at any time?

Who can I choose to receive the payout?

What if something happens outside of work hours?

Some Frequent Questions

What happens when I finish my current job contract?

If you leave the company, you have the option to continue your cover by converting it to a personal plan. This lets you keep all your benefits without needing medical exams or health screenings.

Can I cancel my life cover at any time?

Who can I choose to receive the payout?

What if something happens outside of work hours?

Some Frequent Questions

What happens when I finish my current job contract?

If you leave the company, you have the option to continue your cover by converting it to a personal plan. This lets you keep all your benefits without needing medical exams or health screenings.